is inheritance taxable in utah

Answer Regarding your question Is inheritance taxable income Generally no you usually dont include your inheritance in your taxable income. How Much Is the Inheritance Tax.

Utah Estate Tax Everything You Need To Know Smartasset

Utah Estate Tax.

. Probate ADVANCE Apply Now 1-800-959. Under Utah inheritance statutes the court will follow the intestate succession laws when there is no will. This is because Utah picks up all or a portion of the credit for state death taxes allowed on the federal estate tax return federal form 706 or 706NA.

Heres a breakdown of each states inheritance tax rate ranges. Utahs estate tax system is commonly referred to as a pick up tax. Only 12 states have an estate tax.

Federal changes phased out the national inheritance tax and therefore eliminated Utahs. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only. If you are the surviving spouse filing a joint return with the taxpayer who died in 2021 or 2022 before filing the tax return enter the deceased taxpayers date of death mmddyy on TC-40.

The first step of the probate court is to designate a personal representative to handle. Utah does have an inheritance tax but it is what is known as a pick-up tax. But even though there is no estate tax in Utah you may be assessed estate tax at the federal level.

In general Utah is a low taxing environment. If you live in Utah there is no inheritance tax. While a few states require beneficiaries to pay taxes based on the value of their inheritance Utah does not.

It is one of 38 states in the country that does not levy a tax on estates. If you are gifted something in an inheritance from. Utah does not collect an estate tax or an inheritance tax.

Theres no need to file a notice or acknowledgment that you arent. Inheritance tax applies to the money after it has been disbursed to the beneficiaries who are responsible for paying taxes. Everything You Need to Know - SmartAsset There is no estate tax in Utah.

This interview will help you determine for income tax purposes if the cash bank account stock bond or property you inherited is taxable. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges. However there are ways to avoid probate if you plan ahead.

This chapter is known as the Inheritance Tax Act Renumbered and Amended by Chapter 2 1987 General Session 59-11. Estates must go through probate as required by state law in Utah. This means that the amount of the Utah tax is exactly equal to the state death tax credit that is available on the.

The tool is designed for taxpayers. Even though Utah does not collect an inheritance tax however you could end up paying inheritance tax to another state. Inheritances that fall below these exemption amounts arent subject to the tax.

In Utah the inheritance tax is not levied. There is no federal inheritance tax but there is a federal estate tax. However state residents must remember to take into account the federal estate tax if their estate or the estate they are.

Utah Code Page 1 Chapter 11 Inheritance Tax Act 59-11-101 Short title. But that doesnt mean youre always off the hook when it comes to paying taxes. Utahs state inheritance tax exemptions do.

Utah residents can still be subject to federal estate tax laws only if the value of the deceaseds assets are greater than 11400000. If you inherit from somone who lived in one of the few states. However if the inheritance is considered.

Adoption Taxpayer Identification Number Family Law Attorney Divorce Lawyers Divorce Attorney

State Estate Tax In Utah Shand Elder Law

Historical Utah Tax Policy Information Ballotpedia

Utah Estate Tax Everything You Need To Know Smartasset

Utah Estate Tax Everything You Need To Know Smartasset

Online Relationship Ends In Divorce Divorce Lawyers Divorce Law Cottonwood Heights

Estates And Trust Services 801 676 5506 Free Consultation Tax Lawyer Inheritance Tax Divorce Attorney

Spanish Inheritance Tax Who Gains Spanish Flags Flag Photo National Flag

Utah State 2022 Taxes Forbes Advisor

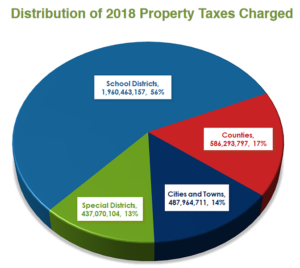

Demystifying Utah S Property Tax Law And Why We Have The Best Property Tax Laws In The Nation Utah Taxpayers

Shadley Soter Utah Needs To Raise The Estate Tax The Daily Utah Chronicle

Utah Inheritance Laws What You Should Know

Voices For Utah Children State Estate Taxes A Key Tool For Broad Prosperity Estate Tax Inheritance Tax Prosperity

What Is An Undisputed Divorce In Utah Utah Divorce Divorce Lawyers Divorce Settlement

Utah Probate Filing Fees Probate Family Law Attorney Divorce Lawyers

A Guide To Inheritance Tax In Utah

Children S Rights In Divorce Divorce Utah Divorce Divorce Lawyers

Capital Gain Tax In The State Of Utah What You Need To Know Capital Gains Tax Capital Gain Education Savings Account